Where can investors look within Euro Credit

Key points:

- Rates are likely to stabilise as disinflation takes hold but oil could still be a headwind

- Current yields offer attractive entry points for euro credit investors

- Short duration and total return strategies may offer opportunities in 2024

Economies may prove to be less resilient in 2024 than they have been in 2023. In the medium-term, growth and inflation outlook are more uncertain with some volatility expected, as the realm of easy money has ended. In this context, we believe that the current landscape is more conducive for generating alpha as heightened volatility creates dislocations that we can potentially take advantage of.

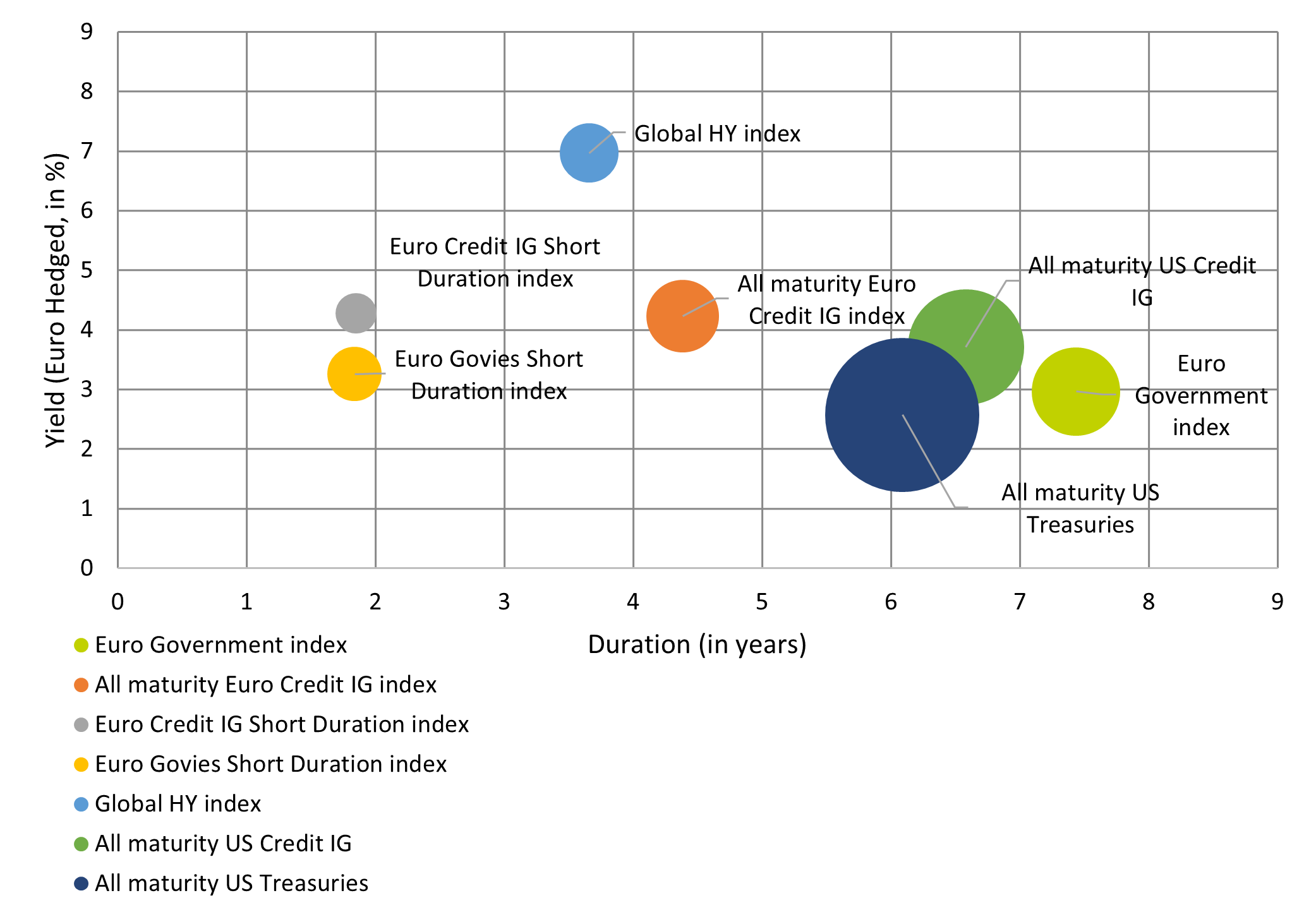

Across euro credit universe, yields are at their highest levels since the Great Financial Crisis driven by recurring rate hikes from the European Central Bank. For example, the Euro Credit IG index currently points at 4.5% yield on the asset class, with a duration level that has decreased over the past 12 months at around 4.5 years.

This is underpinned by company earnings which have been resilient in 2023, as they took advantage of rising input costs to boost pricing power and drive profit margins higher. Besides, corporates have been opportunistic, accumulating significant cash reserves on their balance sheets during Covid-19 when financing conditions where more accommodative. Consequently, there is no immediate need for them to pursue additional funding.

While we have seen some modest spread widening over the past few weeks, we expect it will remain range-bound around 80-100 bps on ASW over the coming quarters. This is because European corporates and financial institutions are well prepared for an economic deceleration. The story is slightly different further down the credit quality spectrum, with European high yield spreads relatively expensive and high level of dispersion of prices observed in the market. Even so, with default rates remaining low at the moment, there are still opportunities with yields around 7.5%1 in the High Yield markets.

What the macro picture currently tells us

One of the main surprises from 2023 has been the resilience of consumers. The markets expected savings to erode and therefore help bring inflation under control. The savings pool, however, was underestimated and this was one of the reasons that rates were higher than planned. As central banks are now indicating a pause in hikes, rates are likely to stabilise for, at least, some of 2024.

There are already signs that the monetary policy is having an impact: the sharp increase in rates had seen been a marked decline in demand for new credit; although the unemployment levels remain low, job creation is decelerating even in countries like France which have been doing relatively well recently. However, long‐term investors should plan on rates being permanently higher than they were from 2008‐2020.

Disinflation is now broad-based across the eurozone however, one of the key headwinds going into 2024 is oil. Oil prices have increased over the past 12 months and are unlikely to fall, which will mean inflation could remain a sticky problem. For the Eurozone, this will be felt more than in the US which has been a net exporter of fossil fuel since 2019. Added to this is the high level of uncertainty and tensions in the Middle East which could lead to a bull flattening if it sparks an energy crisis.

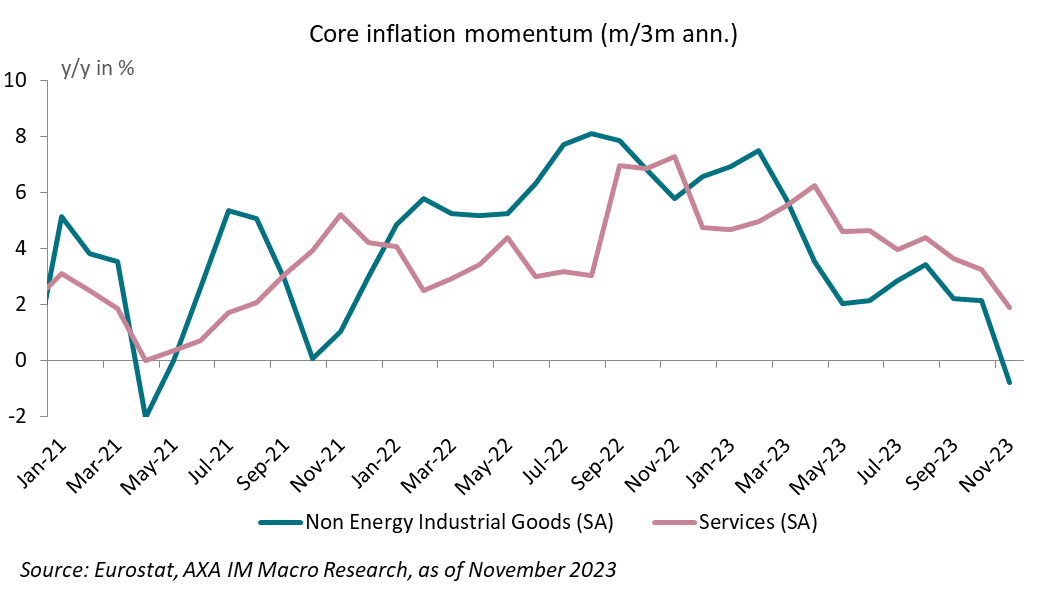

Nevertheless, as the chart below shows, core inflation is down with services manufactured goods prices heading in the right direction.

Short duration and total return

Going into 2024, we prefer short duration and total return strategies which offer attractive yields, a flexible investment approach and aim to mitigate duration risks in market environment prone to uncertainty.

Short Duration IG Credit strategies currently offer high level of yields considering the relatively flat structure of the credit curves. They represent attractive opportunities, especially for conservative investors who are seeking to mitigate interest rate risks and potential drawdowns.

Total return strategies are also worth considering, as they provide flexibility to accommodate challenging market environments. These strategies rely on high conviction positioning focusing on sectors and issuers with the best return potential.

In our view, soft landing is the base case scenario for the coming year, with expectation of easing inflation and a deceleration in credit metrics. Several elements support this soft-landing scenario: financial institution remain well-capitalized, leverage for corporate did not deteriorate significantly and the economy continues to add jobs while overall consumer spending remains robust. This implies that investors can deploy capital at attractive yields with limited downside risks, in our opinion. There is also an entry point for fixed income investors to benefit from a carry effect, that is expected to erode as central banks shift their monetary policies over the course of 2024.

Yields across the fixed income asset class2

As the chart above shows, euro short duration credit currently offers a yield of over 4%3 - a level that we have not seen during the last decade. Even if we expect a small deterioration in corporate fundamentals, this should mostly impact high yield segment and longer dated bonds first. As such, investors should be able to invest in short duration solutions which provide lower volatility and lower interest rate risks while accessing a diversified and liquid market.

- Source: AXA IM, Bloomberg as of 30 October 2023

- Source: AXA-IM, Bloomberg, as of 29th November 2023. The indices referenced are: Euro Government index: ICE BofA Euro Government Index; All maturity Euro Credit IG index: ICE BofA Euro Corporate Index; Euro Credit IG Short Duration index: ICE BofA 1-3 Year Euro Corporate Index; Euro Govies Short Duration index: ICE BofA 1-3 Year Euro Government Index; Global HY index: ICE BofA Global High Yield Index; All maturity US Credit IG: ICE BofA US Corporate Index; All maturity US Treasuries: ICE BofA US Treasury Index

- Source: AXA IM, Bloomberg as of 29th November 2023

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia Limited (“AXA IM HK”), an entity licensed by the Securities and Futures Commission of Hong Kong (“SFC”), for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of BNP Paribas Asset Management or its affiliated companies an offer to buy, sell or enter into any transactions in respect of any investments, products or services, and should not be considered as solicitation or investment, legal, tax or any other advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities under any applicable law or regulation. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation, investment knowledge or particular needs of any particular person and may be subject to change at any time without notice. Offering may be made only on the basis of the information disclosed in the relevant offering documents. Please consult independent financial or other professional advisers if you are unsure about any information contained herein.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee such opinions, estimates and forecasts made will come to pass. Actual results of operations and achievements may differ materially. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Information herein may be obtained from sources believed to be reliable. AXA IM HK has reasonable belief that such information is accurate, complete and up-to-date. To the maximum extent permitted by law, BNP Paribas Asset Management, its affiliates, directors, officers or employees take no responsibility for the data provided by third party, including the accuracy of such data. This material does not contain sufficient information to support an investment decision. References to companies (if any) are for illustrative purposes only and should not be viewed as investment recommendations or solicitations.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and that past performance is no guarantee of future returns, investors may not get back the amount originally invested. Investors should not make any investment decision based on this material alone.

Some of the services listed on this Website may not be available for offer to retail investors.

This Website has not been reviewed by the SFC. © 2026 BNP Paribas Asset Management. All rights reserved.