Global Factor Views: Positive on Growth and Quality but warning signs for Momentum

- 10 April 2024 (7 min read)

KEY POINTS

The US economy has remained strong, underpinned by a robust labour market and productivity growth - the latter partly thanks to increased post-pandemic investment and the continued development of artificial intelligence.

Since the start of the year, inflation has been firmer than expected which has introduced some uncertainly in the outlook for interest rates. However pricing of forward interest rates is still indicating a cut by the Federal Reserve this year.

In the Eurozone there are some signs of a recovery in the service side of the economy, but overall growth generally looks weaker than the US and the European Central Bank is still expected to cut interest rates in 2024.

Equity factor outlook

Given the current macro and interest rate backdrop we have updated our Global Factor Dashboard, shown below.

Exhibit 1: AXA IM Factor Dashboard (April 2024)

Source: AXA IM, April 2024

The scores shown in the interest rates indicator pillar of the dashboard reflect how factors have historically responded to a falling interest rate environment. At present the level and rate of change of the Institute of Supply Management (ISM) New Orders Index1 is in the ‘early acceleration’ phase of the cycle; the scores in the macro pillar of the dashboard reflect how factors have historically performed during this phase of the cycle. Full details of our dashboard/scorecard methodology can be found here.

As things stand after measuring macro, interest rates, valuation and technical elements (e.g. crowding and short-term volatility levels) the highest ranked factors on our dashboard are Growth and Quality while Low Volatility and Value are the lowest ranked.

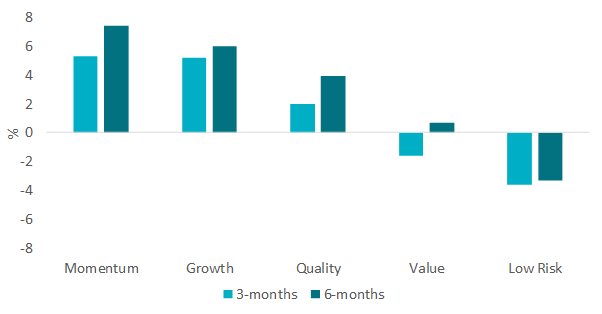

The factor suffering the biggest decline in ranking is Momentum, which as a factor captures stocks that have had a positive price change, relative to the market over the past 12 months. Momentum was the highest ranked factor when we last published our scorecard in November and this ranking was maintained going into the early part of 2024, supported by favourable macro and micro conditions. Since then, Momentum has strongly outperformed, illustrated by the chart below. This has resulted in Momentum becoming more crowded and thus scoring lower on our Technical signal, meaning its ranking has fallen.

Exhibit 2: Global factor performance over the last three and six months

Source: AXA IM, April 2024

We set out in detail our outlook for equity market factors below.

- VGhlIElTTSBOZXcgT3JkZXIgSW5kZXggbWVhc3VyZXMgdGhlIG51bWJlciBvZiBuZXcgb3JkZXJzIGZyb20gY2xpZW50cyBvZiBtYW51ZmFjdHVyaW5nIGNvbXBhbmllcyByZXBvcnRlZCBieSBzdXJ2ZXkgcmVzcG9uZGVudHMgdmVyc3VzIHRoZSBwcmV2aW91cyBtb250aC4=

Growth: Positive

Our macro measure is in the early acceleration phase of the cycle which has historically been supportive of the Growth factor. The prospect of falling interest rates is also supportive of Growth and the prevailing view that rates will soon start to ease explains the improved ranking for the factor. The Technical indicator remains supportive, notably due to a decline in volatility over recent months. The forward valuation for growth, while not cheap, is supportive of the factor at current levels.

Quality: Positive

We remain positive on Quality (equities with premium levels of profitability). Quality stocks tend to be rewarded when macro sentiment is in the early acceleration phase of the cycle. Overall, the valuation of Quality is trading at a premium to average levels; however, unlike other factors, Quality’s performance has not historically been sensitive to periods of high valuation. We would recommend an active approach to Quality investing with a focus on forecast quality which is more adaptive to changing economic conditions.

Momentum: Neutral

Momentum was the highest ranked factor when we last published our scorecard in November. This ranking was maintained going into the early part of 2024, supported by favourable macroeconomic and micro measures. While the macro and interest rate environment still argue in the factor’s favour, its very strong recent outperformance (see Exhibit 2) has resulted in it becoming a ‘crowded trade’ i.e., it has become hugely popular.

A crowding measure that has started to register a negative warning signal is the one-month relative dispersion of returns. This measure gauges the variation of a factor’s returns, and when returns are varied it suggests they are diversified – they are coming from different sources. But when they move together, as is the case currently, this indicates a crowded factor which historically has been negative for future momentum returns. For investors who wish to retain exposure to Momentum we would recommend focusing on earnings momentum which is less crowded and offers a more explicit link to future fundamentals than price momentum.

Value: Negative

Macro and interest rate conditions favour Growth compared to Value. Value has historically underperformed Growth when our ISM index macro indicator is in the early acceleration phase of the cycle. It has historically also suffered when interest rates fall, which the market expects to be the case soon. The Valuation and Technical indicators for Value currently receive a neutral score on our dashboard.

Low Volatility: Negative

Low Volatility is the lowest ranked factor on our scorecard because it tends to underperform when macro sentiment is in the early-stage acceleration phase of the cycle and suffers when interest rates fall. Given the recent underperformance of the Low Volatility factor, valuations now look attractive, and as a result its score has improved on this measure over the last three months. We would note that any downside surprise to the macroeconomic outlook would likely favour the factor’s inherent defensive attributes.

Disclaimer

This website is published by AXA Investment Managers Asia Limited (“AXA IM HK”), an entity licensed by the Securities and Futures Commission of Hong Kong (“SFC”), for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy, sell or enter into any transactions in respect of any investments, products or services, and should not be considered as solicitation or investment, legal, tax or any other advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities under any applicable law or regulation. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation, investment knowledge or particular needs of any particular person and may be subject to change at any time without notice. Offering may be made only on the basis of the information disclosed in the relevant offering documents. Please consult independent financial or other professional advisers if you are unsure about any information contained herein.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee such opinions, estimates and forecasts made will come to pass. Actual results of operations and achievements may differ materially. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Information herein may be obtained from sources believed to be reliable. AXA IM HK has reasonable belief that such information is accurate, complete and up-to-date. To the maximum extent permitted by law, AXA IM HK, its affiliates, directors, officers or employees take no responsibility for the data provided by third party, including the accuracy of such data. This material does not contain sufficient information to support an investment decision. References to companies (if any) are for illustrative purposes only and should not be viewed as investment recommendations or solicitations.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and that past performance is no guarantee of future returns, investors may not get back the amount originally invested. Investors should not make any investment decision based on this material alone.

Some of the services listed on this Website may not be available for offer to retail investors.

This Website has not been reviewed by the SFC. © 2025 AXA Investment Managers. All rights reserved.