2025 Inflation Outlook: High and could be higher

- 06 January 2025 (5 min read)

KEY POINTS

After disappearing from the investors’ risk radar 12 months ago, inflation is now back in focus with expectations of elevated price pressures throughout 2025. The key drivers include:

- Services Inflation: with strong demand in service sectors and ongoing labour market constraints, services inflation is expected to stay elevated and just gradually come off from current levels.

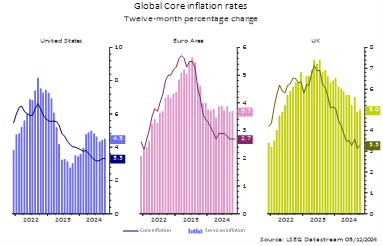

Figure 1: Global core and services inflation rate, % yoy

Source: LSEG Datastream 5th December 2024

- Increased fiscal support: governments globally signalled a ramp up in debt issuance for next year to underpin activity and consumption, this is likely to continue to sustain inflation in 2025.

Impact of Trumpnomics

President Donald Trump’s proposed fiscal agenda is unequivocally inflationary, reflecting increased government spending and tax reforms aimed at stimulating economic activity. Donald Trump has discussed the key economic themes for a second term: migration, tariffs, fiscal easing and deregulation.

However, we consider tariffs and migration restriction to be supply shocks and fiscal easing to be a demand boost. This is likely to see US inflation reaccelerate – perhaps sharply depending on scale and pace of tariffs. We forecast an eye catching 2.8% of inflation in 2025, well above market expectation.

In terms of growth, depending on financial market reaction, we expect US activity to remain solid into 2025 – softening from a robust 2.8% expected for 2024, but likely to remain above trend at 2.3% for 2025. However, assuming broad implementation of Trump’s policies across 2026, we expect to see material headwinds to growth in 2026 to 1.5%.

In other regions, the outlook is more nuanced

In the UK, for example, headline inflation is expected to average 2.5% in 2025, with additional price pressures stemming from tax adjustments outlined in the latest Budget. However, the growth picture is set to remain sluggish as household spending remains subdued.

Finally, inflation in the Euro bloc is forecast to undershoot the European Central Bank’s 2% target for much of 2025 and 2026, reflecting subdued wage growth and structural challenges. This outlook is already priced into markets, limiting surprises for investors.

Amid these dynamics, inflation breakevens remain depressed, particularly in the US and the UK, offering attractive tactical opportunities for inflation-conscious investors. However, our most favoured trade lies elsewhere in long real rates.

Investment opportunities: keep it real

As widely anticipated, G10 central banks pivoted to rate cuts in 2024, marking a notable shift from the aggressive monetary tightening of recent years. This easing cycle, aimed at countering growth headwinds and taming recession risks, came in response to declining short-term inflationary pressures. However, the broader market reaction highlighted a divergence in rate dynamics, particularly for long-term yields.

2024 was indeed a tale of two tenors: While central banks slashed short-term policy rates, long-term yields ended the year significantly higher, a development that caught many by surprise, because of the stubbornly high inflation. We expect the volatility in rates to remain until market participants have more clarity on the deployment of Donald Trump’s agenda, but this is likely to happen in the first months of the year.

However, with growth momentum expected to fade as fiscal policies lose steam, long-duration positions in real rates present a compelling opportunity. Real rates are in positive territory across all markets, and we believe this level remains on the restrictive side. As growth slows and inflation stabilises, long real rate positions are poised to deliver robust returns.

The interplay of policy decisions, inflation expectations, and debt dynamics is shaping a complex investment landscape for 2025. While long-term rates defy traditional patterns, selective opportunities in breakevens and real rates offer value. Investors should remain nimble, navigating the evolving economic environment with an eye on long-term growth and inflation trends, the variable that we expect to remain “higher for longer”.

Disclaimer

This website is published by AXA Investment Managers Asia Limited (“AXA IM HK”), an entity licensed by the Securities and Futures Commission of Hong Kong (“SFC”), for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy, sell or enter into any transactions in respect of any investments, products or services, and should not be considered as solicitation or investment, legal, tax or any other advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities under any applicable law or regulation. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation, investment knowledge or particular needs of any particular person and may be subject to change at any time without notice. Offering may be made only on the basis of the information disclosed in the relevant offering documents. Please consult independent financial or other professional advisers if you are unsure about any information contained herein.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee such opinions, estimates and forecasts made will come to pass. Actual results of operations and achievements may differ materially. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Information herein may be obtained from sources believed to be reliable. AXA IM HK has reasonable belief that such information is accurate, complete and up-to-date. To the maximum extent permitted by law, AXA IM HK, its affiliates, directors, officers or employees take no responsibility for the data provided by third party, including the accuracy of such data. This material does not contain sufficient information to support an investment decision. References to companies (if any) are for illustrative purposes only and should not be viewed as investment recommendations or solicitations.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and that past performance is no guarantee of future returns, investors may not get back the amount originally invested. Investors should not make any investment decision based on this material alone.

Some of the services listed on this Website may not be available for offer to retail investors.

This Website has not been reviewed by the SFC. © 2025 AXA Investment Managers. All rights reserved.