Multi-Asset Investments Views: Not MAGA-bullish but cautiously optimistic

- 30 January 2025 (7 min read)

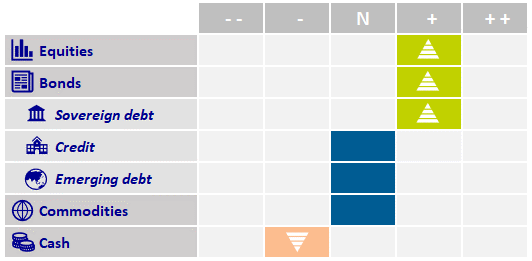

KEY POINTS

Donald Trump has been remarkably active since he was sworn in as the 47th US President on 20 January - signing executive orders, particularly on social matters and pushing his deregulation agenda but showing less urgency on trade tariffs. His focus on “cutting red tape” aligns with his promises to business leaders, many of whom rallied to his side during the campaign or immediately after the election results.

Trump’s aggressive approach to policy — whether on tariffs, deregulation, or social policies — ensures he remains omnipresent, impacting investor sentiment. While deregulation is likely to boost specific industries, such as financials, fossil fuels and technology companies (which no longer fear the Democrat-driven regulation push), Trump’s overall disruptive nature raises significant concerns about long-term stability.

Investors must carefully consider whether this disruption could unlock opportunities or lead to broader market risks, with inflation being the foremost concern. Trump's tariff threats, while still lingering, are so far less aggressive than initially feared. This softer-than-expected stance on trade provided some relief to markets, however, the elephant has not left the proverbial room. Tariff threats create an overhang as investors remain wary of potential disruption to global trade flows. For now, this disruption remains minimal. If Trump escalates tariffs to levels that trigger a trade war, interest rates are likely to rise again from their already elevated levels. This would, in our view, create significant challenges for specific segments of the equity market, particularly small-cap companies with highly leveraged balance sheets.

US equities rebound but inflation still a concern

After a hesitant start to the new year, equity markets found relief following the publication of the latest inflation and retail sales data, both of which came in on the softer side of expectations. This reassured markets that the Federal Reserve (Fed) might not adopt an overly hawkish stance after signaling a pause to its rate cutting cycle.

With inflation showing no signs of re-acceleration, long-term interest rates finally retreated from their highs, providing a much-needed boost to long-duration equities i.e. shares which tend to endure tighter monetary policy. Industrials and homebuilders were among the key beneficiaries of this reprieve. We used this opportunity to rebuild our equity overweight, which we had trimmed earlier in the month. The rebound in US equities, driven by the decline in yields, highlights that inflation remains a key concern for investors this year, with expectations regarding the next move in US monetary policy playing a critical role in shaping market sentiment.

The fourth quarter (Q4) earnings season kicked off with financials leading the charge. Major US banks reported robust results, driven by higher interest margins and strong performance in their trading and investment divisions. We continue to favour US financials, as we believe they can potentially perform well under a Trump presidency on the back of deregulation and fiscal stimulus via tax cuts and infrastructure spending, which should boost banks’ lending activity and therefore profitability.

Meanwhile, the artificial intelligence (AI) breakthrough from Chinese company DeepSeek triggered short-term market volatility and raises questions about semiconductor industry valuations. While it challenges valuations within the AI ecosystem, it also has the potential to create opportunities by driving greater AI adoption and supporting the narrative of long-term growth driven by innovation, rather than signaling a decline in the theme.

Strong start for European equities

In Europe, equities had a remarkably strong start to the year. After being largely unloved in 2024, the region saw renewed interest from global investors. Hopes for better earnings growth, particularly in the luxury sector, were a significant driver behind the outperformance of the CAC 40 Index compared to other European markets.

The sustainability of the recent European equity rally remains a central question. While investors have upped their allocation from previously depressed levels, they are far from heavily overweight, suggesting there is potential for further upside. However, the structural hurdle of sluggish economic growth continues to weigh with the looming threat of US protectionist measures adding to the uncertainty. On a positive note, corporate earnings are expected to benefit from the weaker euro-dollar exchange rate over the past few months, which could provide a tailwind for export-driven sectors.

Growing divergence is a challenge for the Fed

Fixed income markets experienced a volatile start to the year, with significant yield fluctuations. In December, we highlighted that the re-pricing of US rates (higher) pushed us back into the ‘danger zone’ for equities, characterised by a positive equity-bond correlation of equities moving lower when US 10-year yields move higher above the 4.5% threshold.

Since the release of the softer Consumer Price Index inflation data, long-term yields eased from their peak of 4.8% but remain high. Meanwhile, short-term rates remain elevated, reflecting ongoing uncertainty about the Fed’s next steps. Markets currently assign a 22% probability to a rate hike in the next 12 months (see chart below) — a scenario we believe is a miscalculation.

While the US economy continues to show resilience, the growth story is far from uniform. It is a bifurcated landscape, with clear winners and losers across both corporates and consumers. Among companies, cash-rich, large-cap tech firms are thriving, even benefiting, from higher interest rates, while smaller, highly leveraged, companies struggle under the burden of rising interest payments.

Similarly, for US consumers, the divide is stark. High earners with substantial savings are reaping the rewards of rising stock prices and the ongoing cryptocurrency rally whereas lower-income households face mounting challenges from the rising cost of living. This growing divergence underscores the complexity of the Fed's mission, as it seeks to balance economic resilience while addressing the uneven impact of its policies across different segments of the economy.

Disclaimer

This website is published by AXA Investment Managers Asia Limited (“AXA IM HK”), an entity licensed by the Securities and Futures Commission of Hong Kong (“SFC”), for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy, sell or enter into any transactions in respect of any investments, products or services, and should not be considered as solicitation or investment, legal, tax or any other advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities under any applicable law or regulation. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation, investment knowledge or particular needs of any particular person and may be subject to change at any time without notice. Offering may be made only on the basis of the information disclosed in the relevant offering documents. Please consult independent financial or other professional advisers if you are unsure about any information contained herein.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee such opinions, estimates and forecasts made will come to pass. Actual results of operations and achievements may differ materially. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Information herein may be obtained from sources believed to be reliable. AXA IM HK has reasonable belief that such information is accurate, complete and up-to-date. To the maximum extent permitted by law, AXA IM HK, its affiliates, directors, officers or employees take no responsibility for the data provided by third party, including the accuracy of such data. This material does not contain sufficient information to support an investment decision. References to companies (if any) are for illustrative purposes only and should not be viewed as investment recommendations or solicitations.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and that past performance is no guarantee of future returns, investors may not get back the amount originally invested. Investors should not make any investment decision based on this material alone.

Some of the services listed on this Website may not be available for offer to retail investors.

This Website has not been reviewed by the SFC. © 2025 AXA Investment Managers. All rights reserved.