What is the ageing and lifestyle theme?

Ageing and lifestyle describes the changing ways that people are living across the globe as life expectancies rise. Ageing populations are one of the greatest social, economic and political transformations of our time.

For example, the global 60+ cohort is forecast to grow significantly faster than all other age groups – tripling in size between 2000 and 2050 - creating challenges and opportunities for governments, companies and individuals alike.

Forecasted change in global population size between 2000 and 2050

Source: World Population Ageing, United Nations, 2020; World Health Organisation, October 2021

What are the potential benefits of the ageing and lifestyle theme?

The investible opportunities of ageing populations extend far beyond the obvious areas of healthcare. The changing lifestyles and needs of older generations could represent a multi-decade growth opportunity for investors. By 2030, two-thirds of over-60s’ consumption growth in developed markets will be spent across multiple industries dedicated to living well, from beauty and fitness, to travel and entertainment1.

Meanwhile other industries like real estate, financials and healthcare will have to rapidly adapt to retiring and elderly generations’ needs.

We invest in companies operating across four areas associated with the economic implications of longevity:

- Silver spending: Industries dedicated to living well; beauty/aesthetics, personal care, fitness, housing, travel, leisure and entertainment.

- Treatment: Companies seeking sustainable treatment solutions for the coming generations.

- Wellness: The wellness industry includes preventative medicine, personalised treatments, nutrition, beauty and anti-ageing treatments.

- Senior care: Markets for senior housing and specialist assisted living facilities, such as Memory Care that focuses on dementia patients.

- United Nations, data correct as at July 2020

The global number of adults aged 65+ now outnumber children under 5.

Source: United Nations, data correct as at January 2022

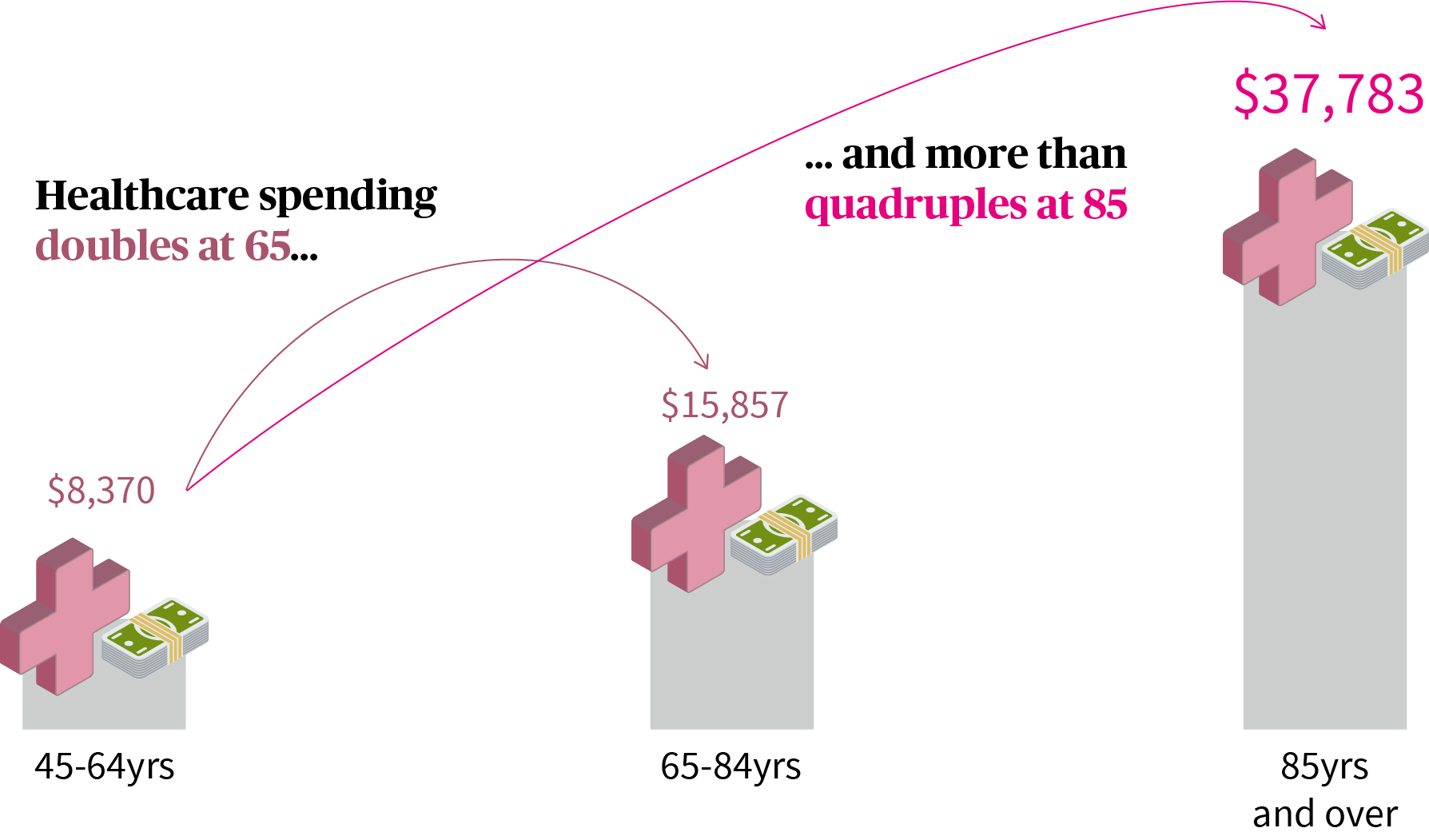

Living longer naturally incurs higher healthcare costs; preventing and treating age-related chronic diseases will be key driver of healthcare spending over next five years. 10,000 Americans hit the age of 65 every day, at which point personal healthcare spending doubles2.

Source: US Centres for Medicare & Medicaid Services

- Health-care dilemma: 10,000 boomers retiring each day, CNBC, 3 October 2017

That means an additional $28bn of deficit each day, according to the World Economic Forum3. The increasing onus for individuals to save for, and enjoy, longer retirements gives wealth managers opportunity in an underpenetrated market.

- Investing in (and for) Our Future – World Economic Forum, June 2019

Access other evolving economy themes

To help people invest in the companies that are embracing these changes, we have adapted our internal research capabilities to incorporate the five main trends that we believe represent the future for long-term fundamental growth investing.

Automation

More industries can now use robotics offering greater sophistication, precision for repetitive or hazardous tasks, and may provide affordable labour solutions.

Connected consumer

Digitalisation empowers consumers like never before with 24 hour, mobile access to a vast choice of products - companies must evolve to remain competitive.

Clean Economy

Innovative companies are creating solutions to address pressures on scarce natural resources and the need for greenhouse gas emission reduction.

Transitioning societies

A rapidly growing global middle class is likely to create growth opportunities as goods and infrastructure demand shifts from the basic to the aspirational.

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia Limited (“AXA IM HK”), an entity licensed by the Securities and Futures Commission of Hong Kong (“SFC”), for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy, sell or enter into any transactions in respect of any investments, products or services, and should not be considered as solicitation or investment, legal, tax or any other advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities under any applicable law or regulation. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation, investment knowledge or particular needs of any particular person and may be subject to change at any time without notice. Offering may be made only on the basis of the information disclosed in the relevant offering documents. Please consult independent financial or other professional advisers if you are unsure about any information contained herein.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee such opinions, estimates and forecasts made will come to pass. Actual results of operations and achievements may differ materially. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Information herein may be obtained from sources believed to be reliable. AXA IM HK has reasonable belief that such information is accurate, complete and up-to-date. To the maximum extent permitted by law, AXA IM HK, its affiliates, directors, officers or employees take no responsibility for the data provided by third party, including the accuracy of such data. This material does not contain sufficient information to support an investment decision. References to companies (if any) are for illustrative purposes only and should not be viewed as investment recommendations or solicitations.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and that past performance is no guarantee of future returns, investors may not get back the amount originally invested. Investors should not make any investment decision based on this material alone.

Some of the services listed on this Website may not be available for offer to retail investors.

This Website has not been reviewed by the SFC. © 2025 AXA Investment Managers. All rights reserved.