What is automation?

Automation is the creation and application of technologies to improve or optimise processes. Automation began life on the factory floor, as automotive companies aimed to improve manufacturing techniques, but has since evolved to influence multiple aspects of how we live and work.

What are the potential benefits of investing in automation?

Automation can help companies:

- Increase efficiency and lower costs

- Improve reliability and consistency

- Perform highly sophisticated and delicate tasks

- Work safely alongside human workers

- Keep pace with customers’ increasingly on-demand preferences

Expected annual growth of the global robotics market until 20251

While we are still in the early stages of this disruptive trend, its long-term potential seems evident to a growing number of equity investors. With an opportunity set across both larger and smaller companies, robotics is increasingly being recognised as a viable investment and potentially superior growth area of the market.

Our Robotech strategy

Our Robotech strategy seeks to provide investors with access to the long-term superior growth potential of the robotics market, an expanding area of the economy with an increasing number of small and mid-cap investment opportunities. This includes:

- Industrial automation: Technologies helping companies increase precision, reliability and efficiency across industries.

- Transport: Technological advances focused on vehicle safety and the pathway towards autonomous vehicles. Additional opportunities outside of the car industry in areas such as agriculture and mining.

- Healthcare: Companies involved in robotic surgery, assistance and remote healthcare.

- Technology enablers: The intelligence that powers and controls robotics. This provides the sensors, connectivity and intelligence used to gather and analyse information

Why invest in automation now?

The demand for industrial robots has accelerated in recent years due to the ongoing trend towards automation and innovative technological advancements. Advances in technology have made robots capable of performing highly sophisticated and delicate work as well as working alongside humans to drive productivity and efficiency.

We believe this is just the beginning of a multi-decade theme:

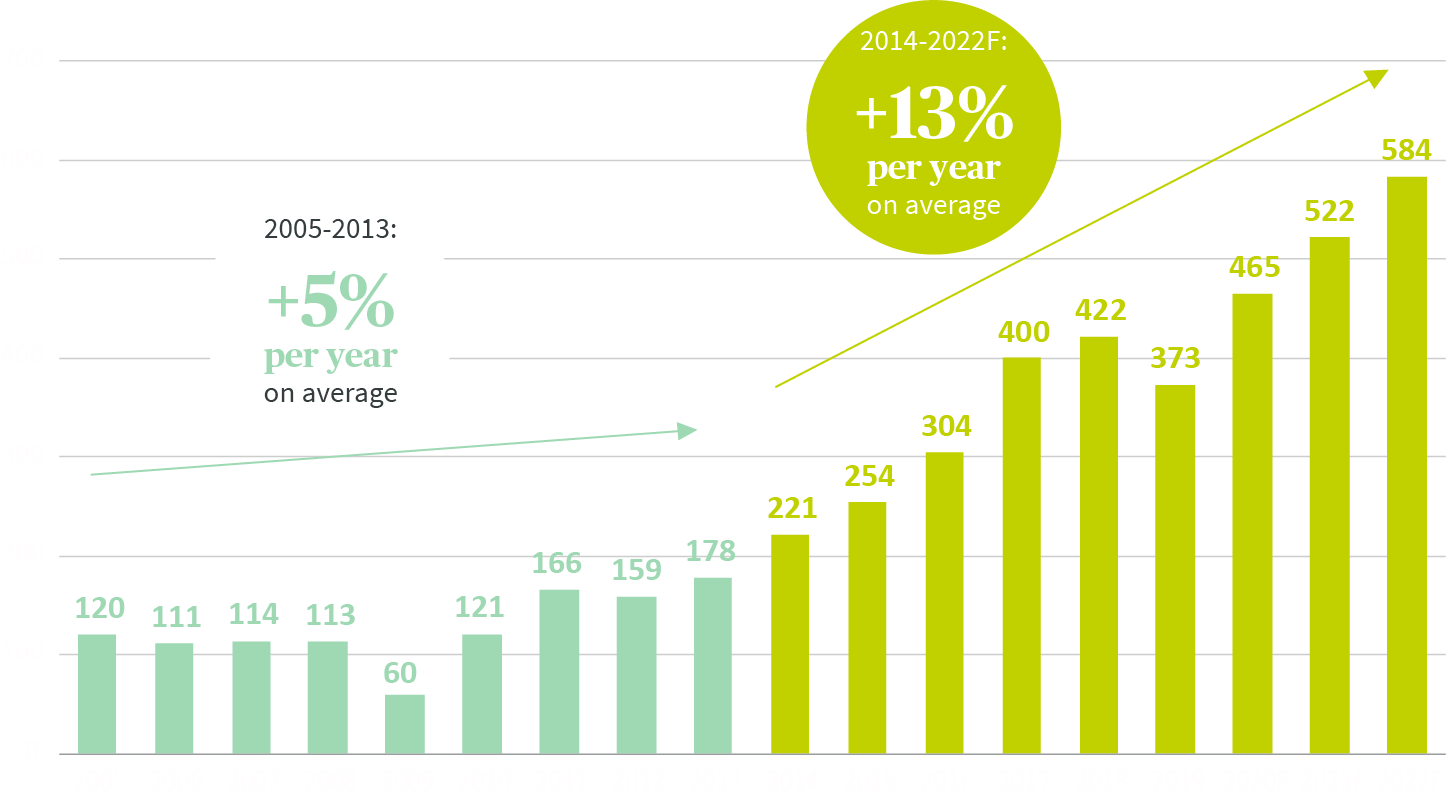

Worldwide supply of industrial robots (units in thousands)

Source: AXA IM / IFR World Robotics 2021

Robots are being used across more industries

As robots become smarter, more flexible and increasingly capable of working alongside humans, they are being used across more industries:

- Alongside the automotive market, the semiconductor and electronics industry is the main user of industrial robots.

- The food and beverage industry has been one of the fastest-growing areas in terms of robotic use over the past few years.

- Robotic precision is also useful for repetitive or dangerous jobs, such as hazardous materials testing.

Robots are also becoming more affordable while labour cost is increasing and the working population is shrinking in many countries.

All investment involves risk and capital is not guaranteed. Such investment strategies are invested in financial markets and use techniques and instruments which are subject to some levels of variations, which may result in gains or losses. Additional risks may include Counterparty Risk; Credit Risk; or risks associated with the impact of any techniques such as derivatives or leverage.

To help people invest in the companies that are embracing these changes, we have adapted our internal research capabilities to incorporate the five main trends that we believe represent the future for long-term fundamental growth investing.

Ageing and lifestyle

Ageing population trends are creating opportunities for long-term growth investors due to growing demand for healthcare, leisure, wellness, housing and more.

Connected consumer

Digitalisation empowers consumers like never before with 24 hour, mobile access to a vast choice of products - companies must evolve to remain competitive.

Clean Economy

Innovative companies are creating solutions to address pressures on scarce natural resources and the need for greenhouse gas emission reduction.

Transitioning societies

A rapidly growing global middle class is likely to create growth opportunities as goods and infrastructure demand shifts from the basic to the aspirational.

Disclaimer

This website is published by AXA Investment Managers Asia Limited (“AXA IM HK”), an entity licensed by the Securities and Futures Commission of Hong Kong (“SFC”), for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy, sell or enter into any transactions in respect of any investments, products or services, and should not be considered as solicitation or investment, legal, tax or any other advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities under any applicable law or regulation. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation, investment knowledge or particular needs of any particular person and may be subject to change at any time without notice. Offering may be made only on the basis of the information disclosed in the relevant offering documents. Please consult independent financial or other professional advisers if you are unsure about any information contained herein.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee such opinions, estimates and forecasts made will come to pass. Actual results of operations and achievements may differ materially. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Information herein may be obtained from sources believed to be reliable. AXA IM HK has reasonable belief that such information is accurate, complete and up-to-date. To the maximum extent permitted by law, AXA IM HK, its affiliates, directors, officers or employees take no responsibility for the data provided by third party, including the accuracy of such data. This material does not contain sufficient information to support an investment decision. References to companies (if any) are for illustrative purposes only and should not be viewed as investment recommendations or solicitations.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and that past performance is no guarantee of future returns, investors may not get back the amount originally invested. Investors should not make any investment decision based on this material alone.

Some of the services listed on this Website may not be available for offer to retail investors.

This Website has not been reviewed by the SFC. © 2025 AXA Investment Managers. All rights reserved.